About Us

Deal Savvy

103 Years of Combined Experience

Tom Corcoran has partnered with Debbie Feldman and Joe Corcoran and they bring a combined 103 years of experience in the hotel industry. By leveraging their network, relationships, and experience, the TCOR team is capable of quickly and efficiently sourcing, acquiring, and overseeing the management of multiple high quality hotels to generate attractive investor returns.

Our Team

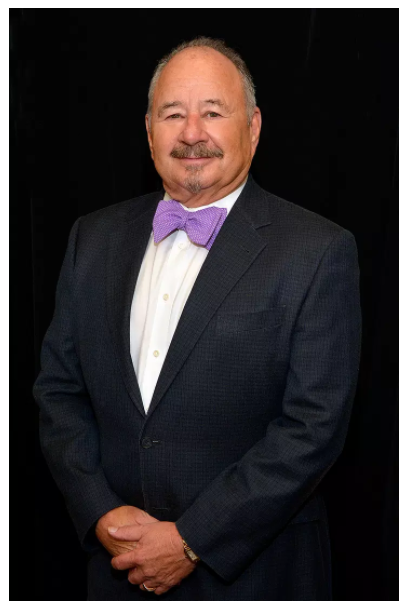

Tom Corcoran

CEO and President

You probably know of Tom Corcoran. If you frequent hotel industry conferences, you have probably been in the audience when Tom received a recognition award for his contributions to the hotel industry.

Debra Feldman

Principal

Debbie learned hotel development since her very early years at the knee of her father, Hervey Feldman, founder of Embassy Suites.

Joe Corcoran

Principal

Joe was a Vice President for The Plascencia Group brokering many notable transactions. Joe developed an expansive network of relationships with owners, lenders, operators, and brands.

$5+ Billion

Hotels acquired and owned.

$3+ Billion

Hotel dispositions

39 States

Hotels acquired / developed

TCOR’s presence in the hospitality industry creates immediate credibility with counterparties and allows for direct access to decision makers from organizations of all sizes

We Are Focused

Focus on Midtown or Suburban Markets

TCOR principals have owned hotels in 39 states and continue to maintain industry relationships throughout the U.S.

Prior experience of the team provides exceptional experience in analyzing and underwriting varied markets.

TCOR currently believes that the most attractive acquisition opportunities will be found in markets with a population over 100,000 and multiple demand drivers, ideally including a leisure component.

Gateway cities and large urban downtown full service hotels will generally not be targeted. Geographies that will be considered include mid-sized cities, suburban areas, mid-town markets, leisure destinations, university towns, airport markets, etc.

On Operations Oversight

On Expense Reduction

On Revenue Management

On Financial and Capital Strategies

important things you should know

Target Investment Criteria

Acquisition and/or conversion of value-add and opportunistic hotel properties or small portfolio.

Branded premium select-service hotels including extended stay. TCOR believes that these types of hotels are the most attractive at this time in the lodging cycle from an ownership and risk perspective due to streamlined operations, higher margins relative to other hotel segments, and favorable market trends. TCOR also has extensive experience in full-service hotels and will consider these assets on an opportunistic basis. TCOR will also seek opportunities for hotels in dynamic markets that could benefit from up-branding to take advantage of higher rated business.

Hilton, Marriott, IHG and Hyatt select-service franchises with a current preference for Hilton and Marriott. These brands align with TCOR principals’ prior experience, TCOR maintains deep relationships with senior leadership at each of these companies, and investors are able to benefit from their strong marketing and brand loyalty programs. TCOR will also target independent hotels on an opportunistic basis and seek to rebrand them under a national flag.

TCOR principals have owned hotels in 39 states and will consider opportunities nationwide. The primary consideration is to identify assets that benefit from multiple demand generators. TCOR will avoid major city downtowns, but will generally be attracted to opportunities in mid-town or suburban markets located adjacent to large cities. Cities with populations below 100,000 will only be considered opportunistically.

Targeting transactions between $10M and $20M, as well as larger size portfolio opportunities. TCOR anticipates financing acquisitions using 60%-70% leverage at closing with the General Partner contributing 5%-15% of the equity check.

Between 80 and 200 keys, less than 10 years in effective age, driven by brand, economics, and location. Focus will be on assets fitting this profile which also have the potential to achieve above 100% market penetration and high operating margins with proper investment and management.

Value-added growth potential through operating efficiencies, new or improved management company, institutional aggressive asset management, repositioning, renovations, or rebranding. TCOR will focus on assets where opportunities to add value can be clearly identified, articulated and achieved.